Weak China Data Signal Slower Growth Ahead

(Beijing) — Disappointing China data released Thursday — investment, industrial output and retail sales in August — point to a second-half slowdown.

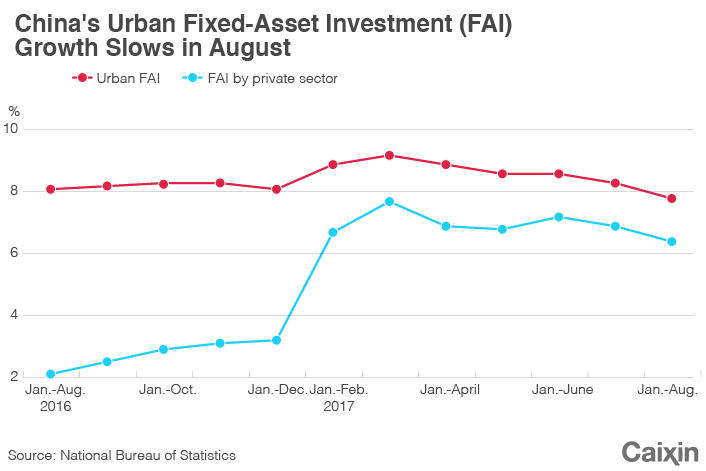

During the first eight months of this year, investment in fixed assets in urban areas such as factories and highways grew at the slowest pace in almost 18 years, up 7.8% from a year ago, according to the National Bureau of Statistics (NBS).

Meanwhile, industrial output in August registered the weakest growth of this year, up 6% from a year ago, the NBS said. Retail sales rose 10.1% from the same month in 2016, the smallest gain in six months.

|

The Chinese government’s ongoing campaign to cut excess industrial capacity and slim down the credit-fueled economy is limiting the near-term growth of the world’s second-largest economy. Analysts have widely factored in a decelerating Chinese economy. Some estimate an economic growth rate of as low as 6% in 2018, which could be the country’s slowest expansion in nearly three decades. China’s gross domestic product grew at 6.9% in the first half.

“August data confirmed the downward momentum” of the economy, wrote Liu Dongliang, a Shenzhen-based analyst with China Merchants Bank, in a note. “The downward pressure may increase further after the fourth quarter of this year.”

Having said that, the slowdown has been gradual and will likely continue to be, analysts predict. The policy of “stability” continues dominating the mindset of policymakers, who are about to enter a leadership transition at the Communist Party’s quinquennial National Party Congress, slated to begin Oct. 18.

“Then the new leadership will gather in (December) to have the Central Economic Work Conference, in which they will discuss the goals and strategies for the economy including the growth target for next year,” Larry Hu, an economist with Macquarie Capital Ltd., wrote in a note. “At that time, both the market and government officials who are in charge of economic policies will have a much clearer vision on the future direction of the Chinese economy.”

Hu expects China’s GDP growth to slow to 6.7% in the second half of the year from 6.9% in the first six months, before slipping further to 6.0% in the full year of 2018.

As local-government funding sources are restricted by the central government, infrastructure investment — a major economic driver — is hit hard.

NBS data show total infrastructure investment rose at the slowest rate this year, up 19.8% in the January-through-August period from a year ago. China Merchant Bank’s Liu added that, local government’s share in those fixed-asset spending grew 16.1%, down from 16.7% in the January-through-July period.

Meanwhile, private-sector urban fixed-asset investment increased 6.4% during the first eight months, also the weakest seen this year.

“Local governments’ funding for infrastructure projects has started to strain since their financing ability was limited by a series of policies” issued by the central government, Liu said. “This came sooner than we had expected.”

The Ministry of Finance has stepped up its crackdown on irregular off-balance-sheet borrowing by local authorities this year in part of efforts to contain systemic financial risks. For example, it has stopped a number of local governments from disguising their debt taken to fund infrastructure projects as the procurement of services from a company.

Property investment grew a 7.9% growth in the January-through-August period, unchanged from the rate in the first seven months.

However, while real estate developers remained keen to acquire land, the increase in property sales slowed in the first eight months of the year from the January-through-July period in terms of both value and floor space. Growth of new housing starts also decelerated.

The government’s policy to curb mortgage growth and lending to property developers, as well as the high comparison base of the real estate sector’s activity this year, “don’t bode well” for the industry in the next year, Hu of Macquarie Capital said.

“Housing price data suggests that the national housing market looks fine at this moment, as both developers and home-buyers are still carried away by the hot market conditions in the past two years,” he said. “But a wake-up call or a tipping point would come up in the next few months.”

Contact reporter Fran Wang (fangwang@caixin.com)